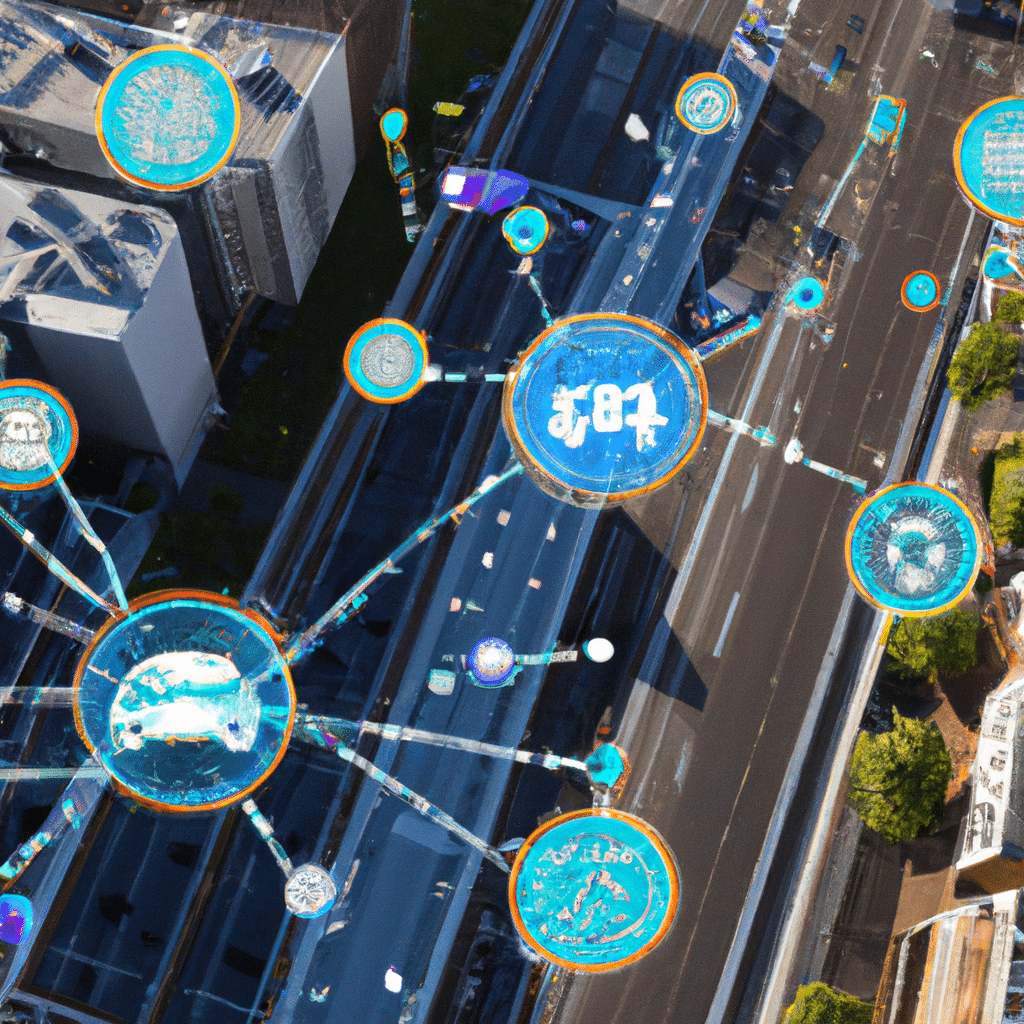

The insurance industry has always been an integral part of our lives. It provides us with a sense of security, knowing that we are protected against losses that we cannot afford. However, with the advent of the Internet of Things (IoT), insurance companies are finding new and innovative ways to transform the industry. In this article, we will explore how IoT is transforming the insurance industry and what it means for consumers.

IoT and Risk Management

IoT devices, such as sensors and wearables, are becoming increasingly popular in the insurance industry. These devices allow insurance companies to collect data on their customers in real-time, which can be used to assess risk more accurately. For example, auto insurance companies can use telematics devices to monitor driving behavior and adjust premiums accordingly. This not only helps insurance companies to reduce risk but also provides customers with a more personalized and fairer insurance policy.

IoT and Claims Management

One of the most significant ways IoT is transforming the insurance industry is through claims management. IoT devices can be used to collect data on accidents, such as the speed and force of impact. This data can be used to determine the cause of the accident and assess the damage. By using this data, insurance companies can process claims faster and more accurately, which improves customer satisfaction.

IoT and Underwriting

IoT devices are also being used in underwriting, the process of assessing risk and setting premiums. By collecting data on customers in real-time, insurance companies can develop more accurate risk profiles. This allows them to offer more personalized insurance policies that better reflect the individual needs of their customers.

IoT and Fraud Detection

Fraud is a significant problem in the insurance industry, costing billions of dollars each year. IoT devices can help insurance companies to detect fraud more effectively. For example, wearable devices can be used to monitor the physical activity of claimants, which can help to determine whether a claim is genuine or fraudulent. This not only helps insurance companies to reduce losses but also helps to keep premiums lower for honest customers.

IoT and Customer Engagement

IoT devices can also be used to improve customer engagement in the insurance industry. By providing customers with access to real-time data on their policies, such as claims history and premium payments, insurance companies can build stronger relationships with their customers. This can lead to increased customer loyalty and retention.

The Future of IoT in Insurance

The potential of IoT in the insurance industry is vast, and we are only just scratching the surface. As IoT devices become more prevalent and sophisticated, insurance companies will find new and innovative ways to use them to transform the industry. From reducing risk and improving claims management to providing more personalized insurance policies and detecting fraud, IoT is set to revolutionize the insurance industry.

Conclusion

Overall, IoT is transforming the insurance industry in many ways. From improving risk management and claims management to enhancing underwriting and fraud detection, IoT devices are helping insurance companies to provide more personalized and fairer insurance policies. As IoT devices become more prevalent and sophisticated, we can expect to see even more significant changes in the insurance industry. By embracing IoT, insurance companies can provide better service to their customers and remain competitive in a rapidly changing industry.